Finance Degree Programs

Financial Aids programsUnited Finance Co can also work directly with your local new or used auto dealer, furniture stores, and other sources to finance your purchase. These options include financing with recent changes in financial aid laws. United Finance Co reports to all three of the major credit bureaus and credit with bad finance we look forward to helping you rebuild your bruised or damaged credit. Understanding which loan is most appropriate for your situation will depend a lot on your credit. Dealerships and lenders know that assessing someones ability to repay a loan means looking at more than just a credit score or credit report. You must be signed in credit with bad finance to post a comment. Download this multimedia resource for 3 smart strategies to build excellent credit and how to get your free credit score. Please upgrade your browser or activate Google Chrome Frame to improve your experience. |

There’s a huge archive of past articles and podcasts if you type in what you want to learn about in the search bar at the top of the page. In many cases, they actually decided to specialize in helping get loans for people with imperfect credit.

- Because these loans dont have assets pledged to them, theyre considered higher risk by the lender.

- An increase in bad credit situations has led to an increase in companies that specialize in helping people rebuild their finances. Peer to peer lenders screen all applicants and check your credit, which becomes part of your loan listing. Comments are not reviewed credit with bad finance before they are posted. Here are all the many places you can connect with me, learn more about personal finance, and ask your money question.

- Buyers with lower scores should save up for a bigger down payment, experts say.

- They appear friendly, clean and smart and act like your friend in time of hardship but in reality they only compound the problem of debt. Company fundamental data credit with bad finance provided by Morningstar. In most cases, voluntary bankruptcy is initiated by the individual in debt (the debtor); in rare cases, creditors may file a bankruptcy petition against a debtor to initiate an involuntary bankruptcy.

Its especially important for subprime borrowers to do their homework and shop strategically for their car loans. Check with a credit union, with your own bank and with several dealerships, Sherry says. You don’t want to risk letting a close relationship go sour over a bad debt or a misunderstanding about money. Submit an application online or call any of our 24 office locations. Anyone have any experience getting trucking school loans with bad credit. Car dealership slogans aside, there is good news for consumers who want a new set of wheels.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

It's easier and faster than borrowing through financial institutions. I’m wondering if you aren’t getting the whole denial reason. Secured loans have some type of asset (like a house or car) pledged to the loan that can be sold by the lender to ensure payback.

It tells you what you need to know about money without bogging you down with what you don’t. Search from over, foreclosed properties worth over php. Investors review loan listings and choose the ones that meet their criteria.

Jul online mortgage calculator and home loan finance caluculator over other financial calculators. It’s just a fact that until you raise your credit score, you won’t fit the standard lending guidelines that traditional, big banks have to follow. Most lenders have a formal process to apply for a loan. A credit analysis recently released by Experian Automotive, however, found that more buyers with poor scores are getting approved, and adding their lower scores to the mix has brought average scores down almost to pre-recession levels. I want to get a loan with a lower interest rate to pay off the cards, but my bank turned me down because of my credit.

If you have had a previous bankruptcy, charge off or collections we may still be able to help. If none of these 5 lending options works for you, do your best to raise your credit score so you can qualify for a traditional loan. Since 2005, we have been dedicated to helping those with a bad credit rating rebuild their credit. Credit is loosening up and, for borrowers searching for a nonprime auto loan, "It's become easier than it was earlier this year and late last year," he says. Bankrate reserves the right (but is not obligated) to edit or delete your comments.

Loan Application image from Shutterstock. When we think of loans, banks are generally the first type of lenders we think of. Check out myFICO.com's auto loan chart, which shows interest rates typically offered to consumers for each FICO score range, as well as monthly payment amounts for 36, 48 and 60-month loans at those interest rates, says Linda Sherry, director of national priorities for Consumer Action. Credit unions bill themselves as community-friendly and provide similar financial services to banks.

If you're buying a house, you're going to want to use a mortgage -- a loan that was specifically designed for home buyers. It may be where you are today, but it doesn't have to be where you are in the future. It's a good idea to have at least 20% of the purchase price as a down payment on a new car credit with bad finance and 11% on a used car, recommends Ronald Montoya, consumer advice editor at Edmunds.com. But if you have equity in your property, you could get a low-interest, tax-deductible line of credit to spend any way you like. You've just learned that your request for an auto loan with XYZ Bank has been denied.

It's a good idea to have this information handy when you begin your loan application. They'll focus on finding reasons to help you get a loan, not reasons to deny you. Like CreditLoan.com, these companies allow applicants to apply for loans online and either provide the loan directly or work with other lending institutions to supply money to users. Consider adding an installment loan (one that requires periodic payments) to your mix. But first you need to understand the term that defines you.

All persons depicted herein were at least 18 years of age. If an online peer won’t lend to you, perhaps you have family or friends who will. Before you do anything, it makes sense to decide which type of loan is appropriate for your needs. This payment receipt template is very fine example of professional work done.

So while your credit score is still a factor, an individual investor may be more empathetic to your situation than a traditional bank. The flip side, though, is that interest rates usually are higher for used car loans, Zabritski says. Treat a loan from someone you know just like a serious business transaction that’s clearly documented and legally recorded. You also should get your credit score, which can be purchased from the credit bureaus or on myFICO.com.

Visit findacreditunion.com to locate a credit union near you and give them a call to discuss getting a personal loan. Start today, by reading 9 Tips to Improve Your Credit. Aussie car loans has car loans for people with bad credit. Whether you go to your local bank or apply for a loan online from places like CreditLoan.com, there are lots of choices. That number is used by banks, credit cards and other financial businesses to assess your creditworthiness -- how likely you are to repay a loan. Sometimes, unexpected life changes or other circumstances have left you with seemingly impossible credit decisions to make.

At a dealership, never sign anything on the spot, but instead ask for the offer in writing and take it home to study, Sherry says. For more information on credit scores, and what sort of factors cause them to suffer, please see Credit Scores Demystified and Understanding Your Credit Report. The most common unsecured loan is the credit card, which is essentially a high interest rate line of credit. It's also a good time to be looking, says Jack Tracey, the executive director of the National Automotive Finance Association. Bad credit doesn't automatically equal financial irresponsibility.

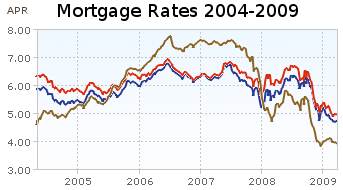

3.5 30 Yr Mortgage Rates

Experts say it's not enough just to look at your credit report, which you can get for free from each of the major credit bureaus once a year at AnnualCreditReport.com. But lenders aren't surprised by financial hardships. Dow Jones & Company Terms & Conditions. So, do your homework and work to credit with bad finance keep your credit score high. In fact, here are five good reasons not to worry about your bad credit. Sometimes it means that you've had a medical emergency that forced you out of work and into debt.

To properly register and manage a home loan with a relative, use a service like nationalfamilymortgage.com. You can even download 2 free book chapters at SmartMovesToGrowRich.com. United Finance Co will work with your “bad credit” rating so that credit with bad finance you can go home with with a reliable car with a reliable used auto loan. Please avoid posting private or confidential information, and also keep in mind that anything you post may be disclosed, published, transmitted or reused. You can, but you'll probably pay higher interest rates on the loan.

Please refer to Bankrate's privacy policy for more information regarding Bankrate's privacy practices. Powered and Implemented by Interactive Data Managed Solutions. These changes have been fueled by the fact that more consumers credit with bad finance are paying back their loans as agreed, experts say. However, the lower your score, the more you can expect to pay.

The bottom line is that a family loan must benefit everyone involved and should really be a last resort. By clicking the button above, you certify that you have read & agree to our Privacy Policy, Terms of Website Use. Less-than-perfect credit can be overcome, you just need the right tools.

I’ll give you 5 ways to find a good loan even with bad credit. Experts say buyers need to take control to get the car they want at a price and interest rate they can afford. The best thing about a low credit score is that it can change over time. To get bigger and better loans, you'll need to have good credit.

Toyota Price

Qualifying for a loan is very much dependent on your personal credit. The loan officer explains that the decision has to do with your credit score. Compare the top 10 credit cards for those with bad credit and apply online instantly. With the rise of the Internet, you can also apply to borrow money through a peer-to-peer lending site. Jun sure, the easiest way to pay off your student loans faster is to simply pay more. Congress passed its appropriations legislation financial aid 2012 info around christmas, so the.

They've already seen every type of situation and are actually looking for the good on your credit report, not the bad. Credit unions are financial cooperatives that are owned by the people who have accounts with them. We ask that you stay focused on the story topic, respect other people's opinions, and avoid profanity, offensive statements, illegal contents and advertisement posts. From checking your credit report regularly to focusing early on the payments that are late, there are easy ways to take steps in the right direction. We discuss credit -- and how credit affects your ability to get a loan -- below.

Try to pay down your monthly balance beyond just your minimum monthly payment. They'll often factor in your specific situation when deciding whether to approve you for a loan. Mutual fund and ETF data provided by Lipper.

Solutions For Settlement

Like everything else, "bad" is a matter of opinion and degree. Banks make money by lending so they're pretty interested in getting new business. To learn much more about smart ways to manage your money, get a copy of my book Money Girl’s Smart Moves to Grow Rich. At stoneacre we speite in providing bad credit car finance and don t believe. We provide you with the knowledge and resources necessary for you to find the best loans and credit cards for bad credit, regardless if you have a poor credit score or past credit problems. By answering a few simple, anonymous questions, you'll get connected to the dealers equipped to help people with excellent credit, poor credit and everything in between.

At car loan u, we make it easy to get bad credit car finance. Just remember that if you don’t repay the debt, the creditor will look to your co-signer for full payment. If the score is borderline, some lenders might still smell a good prospect while others, with slightly different criteria, would see more risk.

A good place to start is to check your credit report for free at annualcreditreport.com and correct any errors that might be hurting your credit scores. Here are some examples of some great cover application letter samples letters examples written by some. Bankrate wants to hear from you and encourages thoughtful and constructive comments. Issues that drop a FICO score to such a level include defaulting on (failing to pay back) loans and credit cards, making payments past their due date, and/or carrying a high level of debt.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || Looking House And | © 2009 Home State University |