Finance Degree Programs

Financial Aids programsIf a debtor sticks to the plan for three to five years, the second mortgage will be forgiven. These options include financing with recent changes in financial aid laws. Our top credit cards comparison makes 2012s best credit cards it easy to compare credit card. These problems will persist until the powers that be decide to offer more than half-measures to address the foreclosure crisis. If the real problem is that you dont have enough monthly cash flow to pay your first mortgage and other expenses, Chapter 13 wont solve that problem. This statement is an admission by Marketplace that it is getting a little gun shy about not talking eliminate 2nd mortgage about peoples financial responsibilities, and how poor decisions can get them into trouble. Getting rid of a 2nd mortgage payment can sometimes make the difference between keeping a home and losing it to a foreclosure. Now is the time to plan ahead, save that home, eliminate junior mortgages, and create lots of equity for the future. |

Yes, they robbed thousands of people, but the people they robbed were dumb enough to fall for it. However, once you were able to pay it, you still didn't.

- Our current economic problems were caused in great measure because millions of Americans confused what they wanted with what they needed.

- Website design by Rowboat Media on Thesis. I did note I tried to negotiate honestly with the bankers but this went nowhere. We had no idea of how rough the journey might become (the last years have been brutal) eliminate 2nd mortgage but the place is exactly where we are supposed to be, now & well into the future. Nevertheless, in today’s market, I can not stress how common and important it is to remove these liens in most Chapter 13 cases that are filed.

- However, if you live in Alabama, Florida, or Georgia, you might be able to remove junior liens in Chapter 7 bankruptcy.

- With our current economy, many homeowners have lost a great deal of equity in their homes. If you meet with one of our highly trained legal staff, we can review your financial picture and help you to determine exactly what steps can be taken to assist you in this matter.

Adjustable rate subprime mortgage borrowers could get more time at low teaser rates — if they can stay current until the deal gets made. I've said it before but why can't those who never default on their mortgage be given a break on there interest rates. As Tess noted in her lead into the story of Leif Madsen and his mortgage problems; I'll make an educated guess that we're gonna get some reaction to this next story. Brokers will usually do this as a courtesy, figuring if you ever do decide to sell your house, youll go through them. Connect the verifone vx to a usb port in the computer. Not all homeowners will be able to do this.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

However, if your house was worth $275,000, then you have equity above and beyond your first mortgage so you cannot strip your second mortgage. Fannie Mae and Freddie Mac immediately proclaimed, however, that they remain eliminate 2nd mortgage opposed to making this option available to struggling homeowners. However, there is an important exception to this rule which applies in chapter 13 cases.

Many have tried to do a short sale or loan modification to no avail and have found that the bank would rather foreclose. What if in 5 years your house now bounced back with the value increasing back to where it previously was or even more. They suspected as much by their own admission. When the lender secured by a first deed of trust forecloses in California, any liens on the property junior (newer) to the foreclosing lien are “cut off”, that is , those junior liens are no longer liens on the property in the hands of the buyer at the foreclosure sale. That $150,000 second lien no longer exists and the $150,000 in equity is yours.

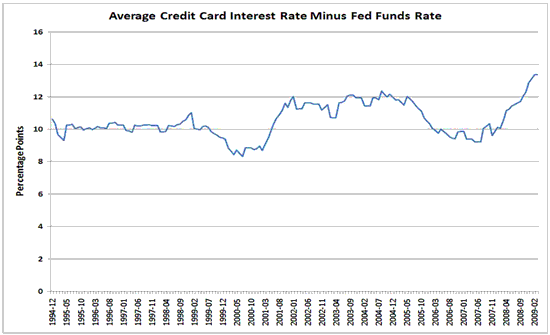

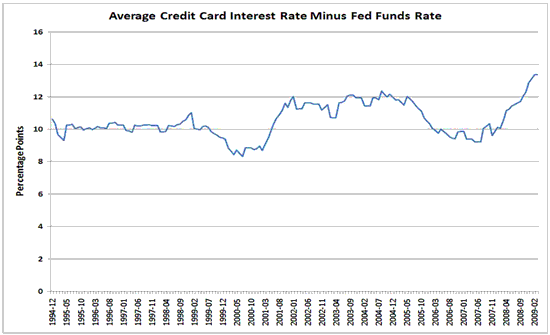

Your credit score impacts what your. I was rewarded with an incentive to practice good financial sense. Trying to revive HAMP, the administration in December announced new regulations designed to push banks into offering more reductions in principal than they have in the past.

It was easy because banks believed home values -- and home equity -- would keep rising. The story of Leif Madsen is a good example. In most districts, you can only use lien stripping in Chapter 13 bankruptcy.

If your home is worth less than what you owe on your mortgages, to the point where the second or third mortgage is not secured by your home’s market value, you can remove the mortgage and never have to pay it. Avisos clasificados de autos venta autos en usados y nuevos con foto. Where the value of the home has fallen below the total outstanding balance of the first mortgage, it is possible to “strip off” the second mortgage in Chapter 13 bankruptcy. Bankruptcy lawyer Ike Shulman says he's helped home owners eliminate as much as $7.5 million of second mortgage debt in the past two years.

As many as four million home owners may be able unload second mortgages if they file for bankruptcy. After all, you went with your attorney to the Meeting of Creditors and your Chapter 13 Bankruptcy plan was confirmed. This all means that when you file for Chapter 13, right away you get the benefit of not having to pay your second mortgage.

With one in 10 Americans out of work, while others have suffered a pay cut as a condition of keeping their jobs, the amount of disposable income available to pay a mortgage is not what it used to be. As the subject of this story (and reading the above eliminate 2nd mortgage comment) I did want to clarify a couple things. Instead, you will pay a portion of this unsecured debt (usually a very small amount) through your Chapter 13 plan.

Its an easy test to take to see if you qualify. Anyone working with them now is basically facing evil directly. That could prevent foreclosures and help thousands of people stay in their homes. Each person's situation is different, you are encouraged to consult a licensed attorney in your state if you have questions about your situation.

This means the second mortgage holder cannot effectively defend against your request, because if the market value is known, and if the second mortgage is wholly unsecured, then the court should grant your request no matter what the second mortgage holder has to say about it. The last example, an execution lien, is an example of a non-consensual, judicial lien. You need to file a bankruptcy court lawsuit against the second mortgage holder to obtain a court order removing the second mortgage.

Cd player tinted nissan sentra lec nissan cebu price ps cebu unit manual transmission. I'm a business owner and make about $150k a year with my small business and still, I would never purchase a house that costs $300k. This guide was designed to help you assess bad credit lender guide your possible credit rating and what.

The teaser-freezer plan will sound eliminate 2nd mortgage good and accomplish little. Additionally, what are the implications for people who do declare bankruptcy and have their 2nd mortgages erased. Stronglite classic deluxe portable massage table package that will surely. In many cases those payments include the mortgage on your home. My point is why is the American psyche now catering the lowest common denominator.

John Davis Wins Lottery, Saving Home From Foreclosure. You can only strip your second mortgage or other junior liens if the amount eliminate 2nd mortgage of the senior liens on the property exceeds the home's market value. Questions should be addressed to attorneys admitted to practice within your state. I am sorry for the trouble he has gotten into, but its trouble that is largely of his own making.

Governor Schwartzenegger and the four largest mortgage servicers have announced a plan to help homeowners with adjustable rate mortgages avoid foreclosure of California homes. Compare the best loans for bad credit side by side find cheap. Somehow I doubt that the bank will just cheerfully absorb the loss. If I never have to deal with financial services again (after this mortgage is paid-in-full) I won't. Join author and database expert adam wilbert essential features for ms access on a tour of the essential features.

Limousines For Sale Used

This is most common these days as a result of the declining real estate market. Over 90% of the new Chapter 13 case we are filing that have real estate are now resulting in lien avoidance actions. If the value of your home now stands at $300,000 due to the economy and the plummeting home values, you may be able to rid yourself of the $80,000 second mortgage through a Chapter 13 bankruptcy filing. Oct if you get a letter from bank of america offering to eliminate the second mortgage. I also didn't declare bankruptcy to run away from debt; I would have gladly faced all opbligations I incurred if I was dealing with ethical business people - this was NOT the case. However, there’s a simple way to avoid this problem.

But since the combined balance of your first and second mortgages ($300,000) is greater than $275,000, then you can still strip your third mortgage. He eventually filed for bankruptcy -- that let him keep the house while he worked out a payment plan for his debts. The vast majority of loan modification requests fail, in part, experts believe, because banks have balked eliminate 2nd mortgage at offering a reduction in mortgage principal, the most effective way to halt costly foreclosures. With every "give" there has to be a "take" somewhere. A last note I would like to add is on the spiritual side.

Loosing my employment and having a family of 6 (4 children, all under age 12 + my wife & myself) forced me to engage in every possible mode for basic survival. If you obtained this type of a loan or refinanced your home and took a 2nd mortgage, you may now find yourself in a situation where you are having trouble making your payments. And millions of people bought homes they couldn't afford and then borrowed against them by taking out second mortgages or home equity lines of credit. Copyright 2012 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice. Housing prices dipped for the third straight month in October, and hope for a recovery in 2011 has started to fade.

In this case, since your first mortgage is greater than your house value, you can strip your second mortgage. If this happens to you, don't be too trusting when your bank tells you not to worry about the foreclosure because they'll continue the auction if there's no answer by the auction date. A bankruptcy is usually preceded by a loss of income, a divorce or medical issues, sometimes all three.

Make sure you ask for the potential sales price rather than a list price, which may be somewhat inflated. The above is not intended as legal advice for your particular situation. I'll explain in a minute how Madsen may be able to wipe away a $30,000 second mortgage.

Bankruptcy is a business decision, no less for a homeowner than it was for General Motors when it filed a Chapter 11 bankruptcy. Meanwhile, the value of his house dropped 20 percent -- meaning there was no equity backing the second mortgage. I did not abuse the system and don't feel sorry for you or for other people in your situation. I have written in the past regarding eliminating junior lien holders on residential real estate, explaining the mechanics of what is involved. The lack of sympathy that you are receiving is due to the fact that you used a savvy legal manuever to get out of paying a mortgage debt that you claim you would pay if you were able to.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || Affordable Brand New | © 2009 Home State University |