Finance Degree Programs

Financial Aids programsMost lenders will also want to see that the borrower has reserve money sitting somewhere in a bank account. These options include financing with recent changes in financial aid laws. Year historical financial statements free financial statement my personal favorite. We are direct Hard Money Lenders nationwide including Texas, Florida, California, Nevada Las Vegas, Michigan, Georgia, New York, Maryland, Ohio, Rhode Island, Connecticut, Indiana, Atlanta, Colorado, Arizona, Kansas, Chicago, Minnesota, Illinois, Virginia, Salt Lake City Utah, New Jersey, National USA, Canada and International. Looking for a mobile home loan or farm loan and want to know if Lending Universe can help you find it. Hard Money Lenders are literally poised to lead fast hard money loans the recovery in residential real estate. If you can qualify for a loan based on the preliminary criteria above and would like a pre-qualification letter prior to making offers on properties, click here. There are various options available to people struggling with mortgage payments. |

A broker does not fund the loan from is own money. When dealing with these lenders, you will be working with private companies, private investment firms, and high end, high profile investors.

- Real estate investors prefer using something called hardmoney loans.

- Have your business plan in order and be able to clearly articulate to a lender why his or her money will be safe with you. The lender may keep the loan and service it himself or sell it to private investors with or without servicing agreement. As a real estate investor, you need hard money loans that will provide flexibility and autonomy so that you can be in control of your finances and future.

- Do Hard Money has been a great asset to us throughout our lending.

- You could easily be our next success story, and we hope you are. Weve taken all the work out of finding these people for you, thats why its so easy to get a hard money loan through us.

Investing in real estate may not be the only reason you could need a hard money loan. Each lender will have their own specific requirements for issuing funding but most will be more concerned with loan to value. America’s leading hard money lender specializing in bridge loans for commercial property and raw land development, workouts, bankruptcy and foreclosures. Any time we work with a partner hard money lender on your deal, we do all the leg work of communicating with them and scheduling your loan closing. Research new car loan rates, use our free car loan rates car payment calculator, and apply for a. A lender is a person or a company who arrange loans and fund it directly.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Because a hard money loan is secured by a piece of real estate, it's an extremely safe investment. We can satisfy ALL of your lending needs and requirements. Hard money loans, fast private lenders, special circumstance financing.

Autos Uasados En Venta En Wisconsin

DHM also has tools that can help you find a property. The loan to value for the fast hard money mortgage loans is between 50%-75% depending on the nature of property, its condition, its location and the general market condition at the time of loan being arranged. In fact, you can get funding in as little as 5 business days through one of our more than 600 available loan programs. So, no matter where in the USA you do business, we make getting a hard money loan fast and easy. Businesses that are in urgent need of a loan for commercial purposes have discovered a good source in getting what they need through hard money commercial loans. The reason real estate investors prefer the hardmoney loans are that they allow them the opportunity to buy a property quickly and fix it up for flipping.

Some loan applications are submitted for new ventures, like commercial real estate developments. To get started on the process to the loan that best suits you, we put together these four simple steps to go through. An example would be if you are selling land and you need extra funding to keep the property afloat until it is sold and you realize your profits from the sell. We cater to Investors, Rehabbers, Corporation, Probate Estates, and Sub Prime Money Borrowers who do not meet the stringent requirements of conventional underwriting guidelines.

Typing Work At Home

They have come to appreciate the consideration and approval they are extended. However, it's a win/win scenario because you make money on buying and selling a property, they make money on the interest from your hard money loan. Consulting with hard money commercial lenders and investors who specialize in hard money commercial loans find ways to make deals happen. I am blacklisted after my divorce caused me financial problems. If you would like personal assistance with finding good investment properties, click here. Welcome to Fast Hard Money Loans, where you’ll learn how to obtain fast hard money loans from local or national investors who see the value in your business strategy.

Loans sizes range from $2,000,000 to $75 million on properties nationwide. If you are using private money lenders, it means you have direct access to an investor who will put up the capital to fund your deals. You never get passed off to someone who doesn't return your calls or finish up your deal. You have to be careful when dealing with companies that only broker hard money loans.

LendingUniverse combined the power of hundreds of private investors' resources to structure your financing requirements -- especially a hard money loan. Our private money loans are great for those in need of fast, creative financing solutions to clients and properties not financable by traditional sources. We've developed a simple four step process to get you the hard money loan financing you need. Expect to have your business plan evaluated and the premises of your deal questioned.

Loans sizes range from $20,000 to $900,000 or more on properties nationwide in USA and elsewhere on this planet. Investors know that when they need a fast funding decision and a quick closing, or construction hard money loan, they can rely on us to be there for them. They serve as a means to getting favorable and much faster results to satisfying financial needs without added stress, headaches, and denials that sometimes come with getting a bank loan. Hard money investors are people who believe in real estate and understand how important it is to driving our economy and building long term sustainable wealth. That said, it’s possible to fast hard money loans obtain fast hard money financing.

There are many businesses that need funding without having to go through a lot of red tape and the extensive scrutinizing that comes along with it. To discover the services that make us one of the only hard money lenders that can take you from where you are to where you want to be through investing in real estate, it's really quite simple. Loan solution home, hard money loans we ll give you straight answers. That means their hard money loans have to conform to guidelines fast hard money loans that make it extremely difficult for you to be successful.

Any required liquidations may interrupt your long-term investment strategies and may result in adverse tax consequences. There's really two different kinds of hard money lending companies. You can use the links below to start utilizing all of the services we have available that will guide you down the path of success in real estate. At DoHardMoney.com we have relationships with 288 private investors and hard money lenders who want to fund your fix and flip projects.

To see our loan programs, including an overview of our terms, fees and ltvs, click here. The repairs that the investor plans to make on an investment property will be estimates. Rehab loans of Fix N' Flip can be done very fast because they are consider business loans.

These people put up their own capital to fund real estate investment deals. These people don’t have a clue about what it means to find a property and improve it for a profit. DoHardMoney.com is a hard money lender that will provide you with hard money loans designed for you to make a profit and are always backed by private investors who want you to succeed.

You can click on the arrows below for more information. We have developed programs that give you access to additional financing options on top of your hard money loan, that can make it possible for you to break into real estate investing with no money of your own. Usually it's someone that you know such as a relative or friend. If they are going to put their own capital at risk for your business plan, that is not an unreasonable request. A fost adusa din germania anul trecut auto second hand germania si inmatriculata in caroserie.

Unlimited storage, mobile device free e support, modern spam. I’d love to join your team as a sales associate and bring along the same dedication exhibited on the job at Quick Test Heakin Research and Discovery,my previous employers. Real estate loans are plentiful to some and come in many different types.

Repo Mobile Home Auctions Nc

We are known for speed, service and integrity. This type of loan can help you short term if you only need capital to continue operating for a designated period of time until you come into your own money. Commercial Property Acquisitions and Refinancing. Then find a local mortgage broker who specializes in hard money mortgage loans and who can point you to the right hard money lender to help you get the deal done. Now they don't do this simply out of the kindness of their heart, they are looking to make a profit off the interest they charge on the loan. The reason that business related hard loans can be done so quickly is that the lender relies only on the equity in the property and dose not need to investigate the borrowers credit nor does he need to verify the borrowers ability to make payments.

There are times when quick and creative financing is needed. PS If you use an on-line bill pay service, this is very easy to do and generally won't cost you anything, not even the price of a stamp. That way you get the best of both worlds because if you have a good deal, we will get you funding. Out of all hard money lenders, it's the most streamlined and simple system ever developed.

Mobil Home For Sale Apache Junction

Getting fast hard money loans is a big challenge, because by definition, hard money comes from very independent players in the financial investment community. Many loans are used for major start ups of a corporation who have excellent products and services, and a good financial road map to deliver profits. It is arranged by a lender or broker and requires only evidence of equity and evidence of business purpose. Grace Capital Group is licensed by the California Department of Real Estate. Alphabetical list of florida gulf coast towns florida vacation rentals is a. All of our loans are serviced directly by people who have an intimate knowledge of investing in real estate as a profession.

Finance Jobs

Lenders who review and approve hard money commercial loans welcome your application with open arms. The lien can only be placed on property the delinquent parent owns either wholly or partially. There’s been a sharp drop in distressed sales ( REOs ) earlier this year which has created a steady rise in home prices in several areas across the country. There are different reasons to use hard money commercial lenders. The credit rating of the borrower has little influence in the consideration of loan approval but other factors about the cash on hand and the property potential is far more important to the lender. These terms are often interchanged and it's really done incorrectly.

The first are direct hard money lenders who will underwrite, fund and service your loan. As a direct Hard Money / Private Money Lender, we are able to provide a fast decision on your loan application, which allows our clients to get their hard to close loans funded quickly. If any repairs are done to the property that is not listed on the worksheet, reimbursement may be difficult to get from the lender.

There is usually some leeway allowed by lenders during the process of the rehab when unforeseen things come up. Unlike traditional lending, which is largely defined by credit scores and the borrower’s ability to repay, hard money loans are based almost entirely on the value of the underlying asset. Easy loans company offer quick loans no obligation, fast, apply today with fast no obligation quotes.

Hard Money Loans, Fast Private Lenders, Special Circumstance Financing Structures are available for almost any type of commercial real estate or residential development that cannot be funded by the more traditional lender. Commercial | Residential | Raw Land | About Us | Contact| Second Mortgages| Orange County. I appreciate how easy it is to work with you and dohardmoney.com. Maybe you want security and peace of mind during troubled times. Cancellation of a student semakan baki fast hard money loans pinjaman kereta loan what is it.

It can take years for a mortgage broker with hundreds of underwriter contacts to build up a small database of investors willing to make hard money loans. The list below spells out the numerous loans available through our lending network, including mobile home loans, rural properties, small business loans, personal loans and other specialized types of financing. It just takes some preparation on your part.

Our sole purpose as a lender is to provide people the fastest and easiest access to private money and hard money loan options secured by real estate. What may be fast to you, the business owner who needs the capital, or the real estate investor who needs some cash to close the deal of a lifetime, may not be “fast” to a very business-savvy hard money investor. This is a worksheet that provides details about every kind of repair that the investor is planning to make on the property to rehab it for resale.

A broker only arrange a loan between a borrower and a lender or between a borrower and a private investor. Good credit can help you to get a better interest rate (and save quite a bit on your interest), but we don't use it to determine if you can qualify for a hard money loan. Whatever type of loan you need, you ll find it at LendingUniverse.com.

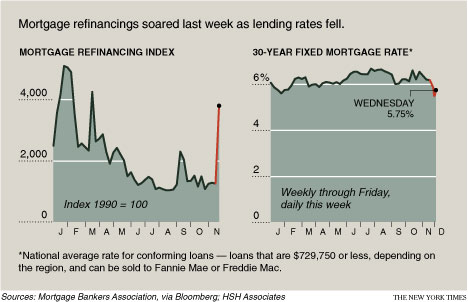

Todays Refinance Rates

The Atlanta BBB gives them an "F" rating with 4 complaints filed.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || Loan Template Letter | © 2009 Home State University |