Finance Degree Programs

Financial Aids programsYour lender can inform you of additional stipulations or restrictions associations. These options include financing with recent changes in financial aid laws. Applicant name street address letter of rejection templates city, state, zip. The administration wants the program to include a provision requiring lenders to take a "haircut" by writing down mortgage balances of deeply underwater loans -- those whose borrowers owe more than 140% of their current home values. Your lender will consider your income and assets, credit score, other debts, the current value of the property, and the amount you want to borrow. Check with the Internal Revenue Service to find home loan refinance the current rules for deducting points. The estimate should give you a detailed approximation of all costs involved in closing. Bear in mind that if the lender did not pay a YSP to the broker, you might have received a lower interest rate on your loan or paid less in points. |

Your local newspaper and the Internet are good places to start shopping for a loan. Those fees are document preparation, administration, processing, application and the like.

- Any lock-in promise should be in writing.

- Cornerstone Mortgage Group is a full service wholesale direct lender. You can also ask for a copy of the HUD-1 settlement cost form one day before you are due to sign the final documents. If you are refinancing from one ARM to another, check home loan refinance the initial rate and the fully-indexed rate. The Mortgage Shopping Worksheet--A Dozen Key Questions to Ask - PDF (33 KB) may help you.

- It will take time to build your equity back up.

- That is money the bank gives back to the mortgage broker for bringing the lender your loan. If your monthly payment on a fixed-rate loan includes escrow amounts for taxes and insurance, your payment each home loan refinance month could change over time due to changes in property taxes, insurance, or community association fees. If you’re a veteran, consider a California VA loan or FHA loan.

Although this information can be helpful, keep in mind that these are marketing materials--the ads and mailings are designed to make the mortgage look as attractive as possible. The president said the plan is an effort to help bolster the housing market, and subsequently the economy. Single or multiple copies of the brochure are available without charge. If your credit score has improved, you may be able to get a loan at a lower rate. Borro provides discreet loans within hours. Some lenders require a complete (and more costly) survey to ensure that the house and other structures are legally where you say they are.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

You can ask your lender for an estimate of the closing costs for the loan. Apply here for usa online banks non chexsystem banks and internet banking. Consider cutting up your cards if you've managed to get yourself so far into debt that your only recourse is to refinance the roof over your head.

Many people come here in need of help with house rental deposit help rent, security deposits and help with. Major banks that allow customers to apply auto loan application for auto loans online include chase. Three years ago, Obama unveiled the Home Affordable Modification Program (HAMP) foreclosure prevention effort and soon followed up with the Home Affordable Refinance Program (HARP), which helps homeowners who owe more on their homes than they are worth refinance their loans.

I knew a lawyer who refinanced his home seven times in the past eight years. This is more likely to happen if your current mortgage is only a few years old, so that paperwork relating to that loan is still current. You can usually find information on interest rates and points offered by several lenders.

See the chart below for annual and aggregate 1st lifetime payday loan lifetime borrowing limits. The program will also offer an option to allow borrowers to refinance into 20-year loans. Would you like to switch into a different type of mortgage. If you’re looking for a fast-paced lifestyle in a place with endless opportunity for recreation and entertainment, consider becoming a home owner in California. If this is the case, it could be difficult for you to refinance.

You may even be able to pay off your mortgage years earlier than otherwise. The refinanced loan is typically in first position; however, it is also possible to refinance a home equity loan. Choosing a mortgage may be the most important financial decision you will make. Refinancing is not the only way to decrease the term of your mortgage.

Looking for an auto loan calculator. You may also want to compare the equity build-up in both loans. Most of the closing costs are waived with this loan type. Shopping, comparing, and negotiating may save you thousands of dollars. If you currently have an ARM, will the next interest rate adjustment increase your monthly payments substantially.

Work Permit Holder Can Get Loan At Singapore

Find out what a dependent eligibility audit is and why they are important. You may want to talk with financial advisers, housing counselors, other trusted advisers, or your attorney. To pay for it, President Obama said he does not plan to add to the deficit. Lender411.com will put you in touch with the best California mortgage lenders and provide you with an array of options to help you determine what loan type best meets your needs. Has your credit score improved enough so that you might be eligible for a lower-rate mortgage. Our straight forward approach makes the loan process quick and easy.

Find Used Cars For Sale

However, this will also increase the length of time you will make mortgage payments and the total amount that you end up paying toward interest. However, before you consider switching out a fixed-rate mortgage for another type, make sure you completely understand the terms of the new loan. Ask the lender offering a no-cost loan to explain all the home loan refinance fees and penalties before you agree to these terms. On the other hand, if your credit score is lower now than when you got your home loan refinance current mortgage, you may have to pay a higher interest rate on a new loan. Loans insured or guaranteed by the federal government generally cannot include a prepayment penalty, and some lenders, such as federal credit unions, cannot include prepayment penalties. A prepayment penalty is a fee that lenders might charge if you pay off your mortgage loan early, including for refinancing.

The form at the top of this page will put you in touch with up to four lenders in your area who will contact you with information about the interest rates they offer. My focus is my customer, they are the most important part of my business. In high interest rate environments, homeowners are attracted to ARMs because they typically are at a much lower interest rate than a 30-year fixed-rate mortgage.

Contact a California lender to find out what your options are. You have different financial needs and personal desires than any other borrower who has ever gone through a home purchase. If you are refinancing with the same lender, ask whether the prepayment penalty can be waived. Review these documents carefully and compare these costs with those for other loans. It’s not enough to simply contact your bank for a loan anymore. If housing prices fall, your home may not be home loan refinance worth as much as you owe on the mortgage.

This was a person who should have been smarter than that because every time he refinanced, he added more principal to the end of his loan and extended the term of his loan. How soon can you pay back your mortgage in full. Cost range = one to six months' interest payments. If your lower interest is substantially lower than your previous rate, you might want to consider shortening the term of your loan in exchange for a slightly higher mortgage payment. But the programs, which sought to help 8 to 9 million homeowners who hold loans from government-supported Freddie Mac (FRE) and Fannie Mae (FNMA, Fortune 500), have helped only some 2 million to date.

Shorter-term mortgages--for example, a 15-year mortgage instead of a 30-year mortgage--generally have lower interest rates. Refinancing may remind you of what you went through in obtaining your original mortgage, since you may encounter many of the same procedures--and the same types of costs--the second time around. The National Bureau of Economic Research has an example of a refinancing calculator. Ask questions about loan features when you talk to lenders, mortgage brokers, settlement or closing agents, your attorney, and other professionals involved in the transaction--and keep asking until you get clear and complete answers. These calculators usually require information about your current mortgage (such as the remaining principal, interest rate, and years remaining on your mortgage), home loan refinance the new loan that you are considering (such as principal, interest rate, and term), and the upfront or closing costs that you will pay for the loan.

Florida Vacation Rent

See What You Should Know about Home Equity Lines of Credit. A refinance loan is a new loan taken out by a borrower to pay off the original loan or, in the case of a serial refinancer, the loan pays off the last refinanced loan. Use the step-by-step worksheet below to give you a ballpark estimate of the time it will take to recover your refinancing costs before you benefit from a lower mortgage rate. These expenses are in addition to any prepayment penalties or other costs for paying off any mortgages you might have. The borrower's mortgage balance also cannot exceed the loan limits for FHA-insured loans in their communities, which range from $271,050 in low housing cost areas to $729,250 in high-cost ones. If you bought furniture, for example, and you pay off the furniture store, you have now financed furniture for 30 years, which may have a useful life of ten.

If you have had your current loan for a while, more of your payment goes to principal, helping you build equity. You may even decide to combine both a primary mortgage and a second mortgage into a new loan. This mortgage type allows borrowers to purchase a home with a minimal down payment of 3.5% of the total property price. In California, values and rates have not coincided this way in recent history. Lenders will look at the amount of the loan you request and the value of your home, determined from an appraisal.

A credit card balance transfer is the transfer of the balance the money owed in a. It is renowned for cities and areas such as Los Angeles, Orange County, Newport Beach, San Jose, San Francisco, Yosemite, and others. How do you calculate the break-even period. By the time you discover this, you are probably closing the loan.

Free Land Contract Forms

If you have an adjustable-rate mortgage, or ARM, your monthly payments will change as the interest rate changes. Another beneficial refinance option is the ARM refinance, which will help you avoid increasing interest rates on your adjustable rate mortgage by providing you with a new fixed rate refinance loan. The nation is currently in a buyer’s market due to low mortgage rates and falling home prices. Debt consolidation is another goal of refinancing. Shopping around for a home loan will help you get the best financing deal. On a $200,000 balance, that would save about $216 a month on a 30-year mortgage.

Then contact one of our lenders to help you further. This will give you a chance to review the documents and verify the terms. See the Consumer s Guide to Mortgage Lock-ins. Our trusted network of California lenders gives you access to rate information, mortgage quotes, lender reviews, and more.

If certain rates change at closing, the lender is required to pay them. Bankrate's refinancing calculator lets you input your costs and the loan terms to calculate the months it will take to recoup your costs. For more details, see the Consumer Handbook on Adjustable-Rate Mortgages. Jul during the worst of the recession, stringent bad credit easy car loan loan requirements shut out many. If you’re short on funds for a down payment, consider a California FHA loan.

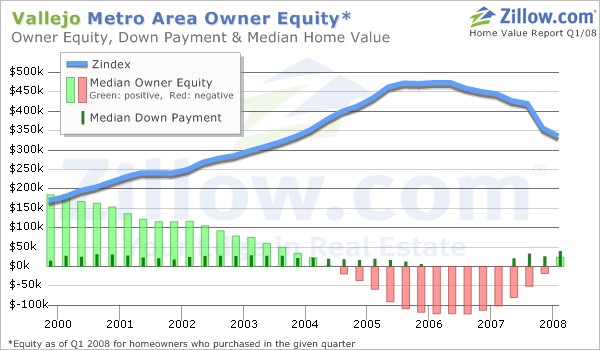

Through our network of qualified mortgage lenders and brokers, we can help you find and select the lender who will provide you the best California mortgage rates and terms. You may want to talk with a trusted financial adviser before you home loan refinance choose cash-out refinancing as a debt-consolidation plan. Lender charge what we in the business nickname "garbage fees," which means they can be negotiated by the borrower. Determining your eligibility for refinancing is similar to the approval process that you went through with your first mortgage. Home equity is the dollar-value difference between the balance you owe on your mortgage and the value of your property.

You may want a mortgage with a longer term to reduce the amount that you pay each month. A lower interest rate also may allow you to build equity in your home more quickly. If you ask, the lender might waive them.

But before deciding, you need to understand all that refinancing involves. Some borrowers take out cash from a refinance to pay off bills incurred by unsecured purchases. You should carefully consider the costs of any prepayment penalty against the savings you expect to gain from refinancing.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || For Sale Cars | © 2009 Home State University |