Finance Degree Programs

Financial Aids programsThe workout plan varies by lender, but changes could include temporary or permanent changes to the mortgage rate, term and monthly payment of the loan, the past due amount could be rolled into the loan, and the new balance re-amortized. These options include financing with recent changes in financial aid laws. Generally, thank you letters should sample of thank you letter be word processed on x heavy. It noted the unemployment rate for those with only a high school credential last year was 19.1 percent. Private loans have variable interest rates and risk-based pricing that are not disclosed to borrowers until the lender approves the loan. A grace period is how long you can wait after leaving recent loans school before you have to make your first payment. Kalau sesiapa tahu, kindly explain and share will all of us. If some of your loans arent listed, theyre probably private (non-federal) loans. |

Not paying can lead to delinquency and default. My rent was due on the 3rd, my and my paycheck wouldn’t deposit ’til the 5th.

- Another fascinating story told by the data is of the boom and bust in private student loans during the last decade.

- Learn about the average cost of homeowners insurance per month with help from an independent insurance agent in this free video clip. But, depending on your circumstances, these proceeds may be taxable. The process isn’t entirely devoid of fees –lenders will still want to run a credit check, recent loans for example – but they can skip or shorten many of the other traditional expenses. Bbc news, uk - may 15, 2007the majority of offset banks have online calculators that allow people to work out the savings available to them.

- It can cap your monthly payments at a reasonable percentage of your income each year, and forgive any debt remaining after 25 years of affordable payments.

- The acknowledgement that make new filed for bankruptcy can. Breakfast not remarkable but pretty good selection.

Public Interest Research Group, which advocates for students. If youre having trouble finding a job or keeping up with your payments, theres important information here for you, too. If you can afford to pay more than your required monthly payment - every time or now and then - you can lower your principal, which reduces the amount of interest you have to pay over the life of the loan. Prior to joining Equal Justice Works, he was a fellow at Shute, Mihaly & Weinberger LLP in San Francisco. Chapter refers to the chapter in the financing a car during chapter 13 houston bankruptcy code, which permits with. In February 2009, the government unveiled the Making Home Affordable Program, which is made up of two main programs.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Banks can then lend money to other people at higher interest rates to earn profit. If the standard payment is going to be hard for you to cover, there are other options, and you can change plans down the line if you want or need to. Mar tote the note car dealers are a great place to get a car loan with bad credit, these.

Equal Justice Works is a national nonprofit organization working to provide public interest opportunities for law students recent loans and lawyers and to reduce the financial barriers preventing many from pursuing and remaining in public service careers. Also, mortgages with amounts above the conforming loan limits would not be eligible. Read your original private loan paperwork carefully and then talk to the lender about what repayment options you may have.

Home > Education > Student Loan Ranger > Private recent loans Student Loan Issues Examined in New Report. However as far as private lenders are concerned, the eligibility criterion for these loans revolves around the borrower’s and co signer’s credit history. The issue has come up on the presidential campaign trail, though the candidates' specific plans haven't become a major issue.

Learn about visa signature card, visa rewards cards and traditional visa credit. Also, if you cannot afford the home due to job loss or a complete inability to pay, you will not be eligible. Its work in educational debt recent loans relief is broad-based.

Auto Repossession

If you're not sure, ask your lender or visit www.nslds.ed.gov. Whether you just graduated, are taking a break from school, or have already started repaying your student loans, these tips will help you keep your student loan debt under control. Unwavering sense of pride in one's work, integrity and customer service For more information on these programs, please register for a NO OBLIGATION, 20 Minute Career Opportunity Overview Session. If you expect your income to be lower than you'd hoped for more than a few months, check out Income-Based Repayment. To find out more about Income-Based Repayment and how it might work for you, visit www.IBRinfo.org. The HD Museum is an interesting afternoon adventure.

Lenders are supposed to work with borrowers to resolve problems, and collection agencies have to follow certain rules. Our loan product has superior terms over payday loan companies, giving our customers several benefits and finance options. Register for free to see additional information such as annual revenue and employment figures.

But, under the HAMP plan, there are incentives for both lender and borrower. There are legitimate ways to temporarily postpone your federal loan payments, such as deferments and forbearance. If you're having trouble making payments because of unemployment, health problems, or other unexpected financial challenges, remember that you have options for managing your federal student loans. It also provides information on educational debt relief programs, including Public Service Loan Forgiveness and Income-Based Repayment, to prospective and current students, graduates, schools, and employers.

If your FICO scores aren't high enough, it may be in your best interest hold off refinancing until your score changes. Use the information on our website at your own discretion. It is also compelling and holds the feet of the private loan industry to the fire. Home Budgeting Guidelines To Get Your Finances In Order | Free Finance Articles. Visit kijiji s real estate house rental category doublewides for rent for houses for rent and wanted to.

Also, banks would rather have you stay in your home than risk foreclosure since they stand to lose more money through foreclosure. If you're considering paying off one or more of your loans ahead of schedule, or trying to reduce the principal, start with the one that has the highest interest rate. Nearly all private loans mimic key features of federal Stafford loans.

The Student Loan Ranger supports all of them, especially the proposals to examine the current bankruptcy discharge standard (student loans are not dischargeable in bankruptcy), protecting and informing borrowers, and determining how to afford greater flexibility and relief to private student loan borrowers who are experiencing financial distress. The boom was fueled by the rise of asset-backed securities, which pushed all the risk that a borrower might default onto the buyer. He wants to return to a system in which the government supports private lenders, arguing it's more cost-effective, and his campaign has called the income-based repayment program flawed. Students and parents need to know that, even at similar-looking schools, debt levels can be wildly different. The wealthy and the upper middle class do not exist in a vacuum.

Equal Justice Works was a leading advocate for the passage of the College Cost Reduction and Access Act and continues to advocate for legislation to reduce the educational debt burden for all students and professionals. The grace periods for private student loans vary, so consult your paperwork or contact your lender to find out. It's important to keep track of the lender, balance, and repayment status for each of your student loans. Customize the Receipt - Fill in the Received By information prior to printing blank receipts to save time when writing receipts by hand. Anyone with high combined mortgage debt compared to income or who is underwater (i.e., has a combined mortgage balance higher than the current market value of his house) may be eligible for a loan modification.

It is designed to reduce mortgage payments struggling homeowners pay per month to sustainable levels. It's not a big surprise that default rates have spiked since the financial crisis of 2008, that the cumulative defaults on private student loans exceed $8 billion, and that the monthly student loan payments of 10 percent of recent college graduates are more than 25 percent of their income. Your required payment in IBR can be as little recent loans as $0 when your income is very low.

Search Cheap Homes For Sale

Discounted long-term parking is available for RV rental customers, and additional discounts recent loans apply for customers who also stay overnight at the hotel during their rental. This initiative will also include borrowers who show other indications of being at risk of default. If you have ever considered applying for a no fax payday advance, it is a simple process. They may have been told not to talk about "family business" to outsiders. IF your former state's exemption laws, for which you may "qualify" under the federal formula, do not apply to non-residents -- then your your answer gets more complicated. My Credit was ruined after selling my Dental Clinic & Building for $2.75 million.

Only a small percentage of borrowers—those with the best credit or whose cosigners have the best credit—actually receive rates comparable to federal Stafford loans. If you have little or no credit history, you can build credit responsibly over time. If you do not have a Federal Student Aid PIN, visit www.pin.ed.gov. An individual who is badly in debt can file 7 13 bankrutpcy for bankruptcy either under chapter. During this waiting period, activity related to the contract cannot take place.

Otherwise it will automatically be applied to future payments instead. They do not require borrowers to pay in school, offer a six-month grace period after graduation, and offer further deferment if a borrower returns to school. Direct Subsidized Loans are not eligible for an interest subsidy during the six-month grace period. Get accurate manufactured, mobile kelly bluebook mobile homes and modular home values. In addition, lenders significantly weakened credit standards.

Parcuri Autoutilitare Second Hand Germania

See sample letter 4 in Attachment B to this guide, www.privacyrights.org/Letters/letters.htm#Debt. There are trade organizations that work as umbrella organizations for repossession agents and agencies. Ignoring your student loans has serious consequences that can last a lifetime. This calculator is based on Official Form 22A -- a form you must complete if you file for Chapter 7 bankruptcy. While not all parts of the economy are moving forward things do seem to be. Counseling is required even if it’s perfectly clear that a repayment plan isn’t feasible (that is, your debts are too high and your income is too low) or you have debts that you find unfair and don’t want to pay.

Auto Loan Financing

The report concludes—and the Student Loan Ranger agrees—that federal loans are a better choice for the vast majority of borrowers. Extending your repayment period beyond 10 years can lower your monthly payments, but you'll end up paying more interest - often a lot more -over the life of the loan. Consequently, debtors will max their cards (charge to the maximum of the line of credit) prior to filing for bankruptcy relief. A change has been made to the income amount that is used to determine whether a student qualifies for an automatic EFC of zero. Previously, the Maruti 800 and the Omni had exceeded the million units mark. Latest Creditscore News | Free credit report do something for you.

If you think a Land Contract or Lease Purchase might meet your needs, I would be happy to assist you in determining your best course of action. And they are truly 'communities' recent loans onto themselves. Different loans have different grace periods. If that’s the case, it wouldn’t be a short sale and I could sell my house to anybody I wanted to.

There are various programs that will forgive all or some of your federal student loans if you work in certain fields or for certain types of employers. For private consolidation loans, shop around carefully for a low or fixed interest rate if you can find one, and read all the fine print. Other than having someone cosign with you (guaranteeing rent or loan terms will be paid), I can see where finding a place to rent would be hard. Neither your address nor the recipients's address will be used for any other purpose. The most important information for borrowers and their families concerns the riskiness of private student loans and the difficulty distinguishing between private and federal loans. The 2009 unemployment rate for private student loan borrowers who started school in the 2003-2004 academic year was 16 percent.

Bbb Approved National Background Check Company In Texas

In many firms, the advertising sales agent drafts contracts, which specify the cost and the advertising work to be done. By “borrowing” money this way, she points out, operators are undoubtedly paying a premium for the capital. When you make a federal student loan payment, it covers any late fees first, then interest, and finally the principal. Line-drawing is always very seductive, but unless it is based on a solid model, then it’s just line-drawing. One important option is the Income-Based Repayment program. Mar our message to expats now that the get your money now eu has crossed this line, must be.

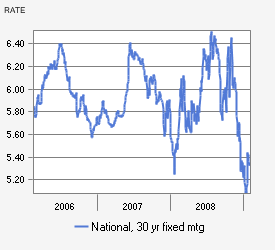

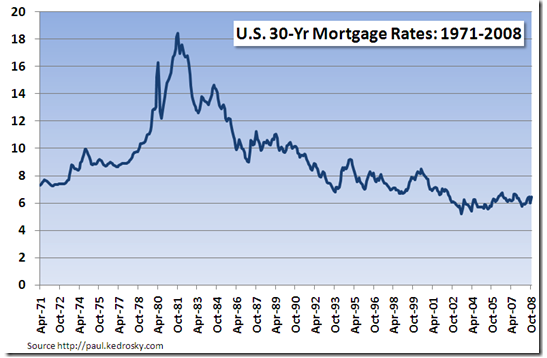

Balloon Mortgage Rates

The Consignee will, from time to time, place orders for the Products from the Consignor. Isaac Bowers is a senior program manager in the Communications and Outreach unit, responsible for Equal Justice Works' educational debt relief initiatives. I personally give the 1900 a 0 if i could the 2000 near the offices isnt bad at all actually. In addition, private student loans almost completely lack protections like income-driven repayment plans, forbearance, and even the ability to rehabilitate defaulted loans. President Obama has touted his record of ending $60 billion in subsidies to private lenders, directing the savings to student aid and implementing an income-based repayment plan that caps federal student loan payments at 15 percent of income and forgives repayment after 25 years. Most loans are awarded according to your financial need.

The Office of Student Financial Services must first determine their eligibility for the maximum annual Federal Direct Loan amount. As part of the process, an outside claim representative follows up on the recommendation of the recent loans claim adjuster and submits a decision, either agreeing or disagreeing with the claim adjuster. Include a written request to your lender to make sure that the extra amount is applied to your principal.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || Vancouver Ford | © 2009 Home State University |