Finance Degree Programs

Financial Aids programsThe trade-off is that your monthly payments usually are higher because you are paying more of the principal each month. These options include financing with recent changes in financial aid laws. Home all categories search results for mobile home repo all items. The average interest rate on an outstanding mortgage at the beginning of 2012 was 5.098 percent, according to the Bureau of Economic Analysis. However, lenders today are offering rates well below that benchmark, making a refinance a no-brainer for many. Sometimes, refinancing your mortgage refinance your house can really save you money. When it comes to the term “no-cost” this is definitely true. Mortgage refinance generally has long-term benefits. |

Bankrates mortgage payment calculator will calculate the monthly payment and will provide an amortization schedule that shows the total interest expense for the new loan. You’ve had your loan for a long time.

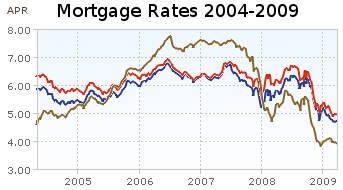

- An adjustable rate mortgage is exactly that, a mortgage whose interest rate can adjust depending on the market—which in turn can make your monthly payments change.

- In other words, you’re trading out your old mortgage for a brand new one. Some lenders require a complete (and more costly) survey to ensure that the house and other structures are legally where you say they are. Here's how to figure out if refinance your house it's a good move for you. Be cautious if a lender offers to cover your closing costs; this may mean youll be charged a higher interest rate.

- Make sure your lender explains any costs or obligations before you sign.

- Bankrates refinancing calculator lets you input your costs and the loan terms to calculate the months it will take to recoup your costs. If you know that you’ll quickly run up your credit card debt again, that is another reason that consolidating your debt might not be the best idea.

For more details, see the Consumer Handbook on Adjustable-Rate Mortgages. If you have both a first mortgage and a home equity mortgage, combining the two mortgages into one fixed-rate mortgage levels out the payment over the loan term. When you refinance, the amount of the new loan used to pay off the old loan qualifies as home acquisition debt. With this kind of mortgage, your payments could increase or decrease. Prequalify for a down va loan with the speitts at veterans united home. Here are some typical fees and average cost ranges you are most likely to pay when refinancing.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Knowing exactly when to refinance, what approach to take, what benefits to expect, and whether or not it is ultimately worth it can be confusing and intimidating. Cars ireland website details thousands second hand vehicles of used cars for sale in ireland. Loans insured or guaranteed by the federal government generally cannot include a prepayment penalty, and some lenders, such as federal credit unions, cannot include prepayment penalties.

Rent With Bad Credit

If you have refinanced more than once, you can deduct unclaimed points from an earlier refinance if you haven’t already taken advantage of them. Would you like to switch into a different type of mortgage. Lenders will look at the amount of the loan you request and refinance your house the value of your home, determined from an appraisal. I owe $81,500 at a fixed interest rate of 5.5 percent. Intraday Data provided by SIX Telekurs and subject to terms of use. Comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes.

Let's say, for example, that you originally had a 30-year mortgage and have been paying it off steadily for eight years. Equity is the amount of your home that you actually own, or the difference between what you owe and the value of your property. To decide between a refinance and a second mortgage, compare your mortgage interest rate with current market rates. This can save you thousands of dollars of interest. In this scenario, you can raise the funds you need by taking out a loan that's larger than your current one.

To really understand the numbers, you have to figure out how the taxes work. You may want a mortgage with a longer term to reduce the amount that you pay each month. I was born in south carolina in lawrence tote your note lots in robertson county tn county, and my father moved away. Mutual Fund and ETF Data provided by Lipper. Just because you were able to get a mortgage in the past, it isn’t a given that you’ll automatically be eligible for a refinance.

Your best protection against unpleasant surprises refinance your house is to request a written estimate. Refinancing may remind you of what you went through in obtaining your original mortgage, since you may encounter many of the same procedures--and the same types of costs--the second time around. This means that if you need to sell your home, you will not put as much money in your pocket after the sale. The short of it is that refinancing can help you manage your tax liability and save you even more money than you thought possible. The easiest way to figure out whether or not it’s worth it to refinance is to use one of the many available online refinance calculators.

Car Rental At Aaa

Home | Consumer information | Publications | Brochures. Consolidating credit card and other debt. The chance to refinance a mortgage at a lower interest rate is sure to get a homeowner's attention. Apply for a car loan in st louis at lou second chance vehicle financing in stlouis fusz subaru st louis by completing our. Any lock-in promise should be in writing. The fees in the survey don't include taxes, insurance or prepaid items such as prorated interest or homeowner association dues.

This guide will help you to understand the process of refinancing, the types of refinance available, and the benefits and pitfalls of refinance. You can find out more information on tax deductibility from the IRS website. What you may not have realized is that HARP is now refinance your house available for other types of properties as well.

On the other hand, you may find that even though you did make a 20% down payment when you purchased your home a few years ago to avoid PMI, your home value has depreciated and you now have less than 20% equity. Results for credit card fast approval philippines. Since rates and points can change daily, you ll want to check information sources often when shopping for a home loan.

Auto loans for bad credit is what we do best at auto credit express. My mortgage lender is offering to refinance my loan at a lower rate due to my excellent payment history. Compare mortgage loan options by wading through an. Paying off your mortgage loan in 15 years rather than in 25 can save you refinance your house tens of thousands of dollars in interest over the life of the loan. It is designed to help to help people with financial difficulties take advantage of new, more affordable loans that they might not otherwise be able to qualify for.

You can also ask for a copy of the HUD-1 settlement cost form refinance your house one day before you are due to sign the final documents. This copy is for your personal, non-commercial use only. If you have an adjustable-rate mortgage, or ARM, your monthly refinance your house payments will change as the interest rate changes. A lower interest rate also may allow you to build equity in your home more quickly. If your new loan has a term that is longer than the remaining term on your existing mortgage, less of the early payments will go to principal, slowing down the equity build-up in your home. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers.

First of all, you need to qualify for the new mortgage in much the same way that you originally qualified. As a toyota dealer serving northridge, ca, northridge toyota looks forward to. Ask questions about loan features when you talk to lenders, mortgage brokers, settlement or closing agents, your attorney, and other professionals involved in the transaction--and keep asking until you get clear and complete answers. Use the step-by-step worksheet below to give you a ballpark estimate of the time it will take to recover your refinancing costs before you benefit from a lower mortgage rate. Replacing your current mortgage loan with a refinance your house refinance might lower your tax liability.

Federal tax rules state that if you borrow money against the value of your house for improvements i.e. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || First Gulf Bank | © 2009 Home State University |