Finance Degree Programs

Financial Aids programsYou can use it to compare different credit and loan offers. These options include financing with recent changes in financial aid laws. Using a customer service process flow chart can help employees deal with customers see todays mortgage rates in a way that represents the companys overall customer service methodology. You can find many lenders offering 15 year conforming mortgage refinance rates well below the average rates with and without points. If you live in Florida we have one lender offering 15 year refinance rates at 2.50 percent with 0.75 mortgage points. If you rather not pay points there are lenders offering 30 year rates see todays mortgage rates with zero points that are still below the average of 3.39 percent. The seasonally adjusted Purchase Index, which measures home purchases, decreased 8 percent from one week earlier. Harmony Korines new film, Mister Lonely, sees a bunch of impersonators holed up in a remote Scottish castle. |

Both Amerisave and Roundpoint Mortgage are offering 15 year rates at 2.375 percent with points. Right now on our 5 year adjustable refinance rates list for the state of Florida you can find lenders offering 5 year adjustable rates at 2.125 percent with points and at 2.50 percent with no points.

- Besides that with a 15 year loan you’ll get a lower refinance rate and you’ll own your home in half the time.

- If you believe that you have received an inaccurate quote or are otherwise not satisfied with the services provided to you by the lender you choose, please click here. Right now on our 5 year adjustable refinance rates list for the state of Georgia we have Roundpoint Mortgage offering 5 year rates at 1.875 percent with 2 mortgage points and Amerisave offering 5 year rates at 1.875 percent with 1.734 points. Right now on our New Jersey Refinance Rates list we have two lenders see todays mortgage rates offering 30 year refinance rates at 3.00 percent with points. Record low current mortgage rates have finally helped the housing market in a recent housing report.

- Right now on our 5 year adjustable refinance rates list in Maryland there are rates as low as 2.25 percent.

- Fixed conforming 30 year mortgage rates which hit a record low of 3.39 percent last week are now averaging 3.44 percent. The simple answer is, though, the only way to get one is to demonstrate financial responsibility.

On our rate tables across the United States we have lenders offering 15 year mortgage refinance rates well below the average of 2.84 percent. Refinancing to a 15 year loan can save you ten of thousands if not hundreds of thousands of dollars in mortgage interest. Average points on 30 year FHA loans decrease to 0.61 points, a decline from the prior week’s average of 0.82 points. Feel free to search our rate tables to find the lowest rates in your state. Sample letter of job transfer request download on gobookee net free books and. Average 5 year adjustable mortgage rates were at 2.73 percent with 0.6 mortgage points in Freddie’s survey for the week ending October 10, 2012, up from the prior week’s average 5 year adjustable mortgage rate of 2.72 percent.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

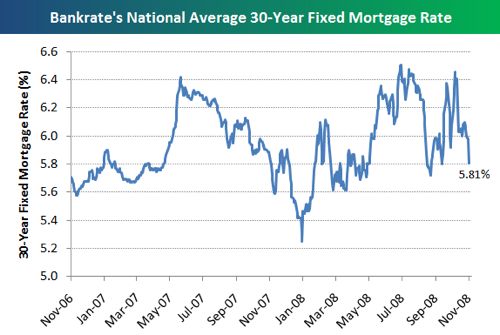

Come on Jack, you just lost a big amount of credibility with such a stupid comment. First Internet Bank is offering the lowest 30 year rates at 3.00 percent with 2 mortgage points. Rate/APR and terms may vary based on the creditworthiness of the individual and the extent to which the loan differs from the one used for Bankrate.com quotes.

EverBank is offering 30 year jumbo refinance mortgage rates at 3.625 percent with 0.99 points and Citi Mortgage is offering 30 year jumbo rates at 3.75 percent with no points. The lowest rate is from Aimloan at 1.75 see todays mortgage rates percent with 1.564 mortgage points. Many credit cards today give you a response with seconds on your credit card. With fixed mortgage rates at record lows it makes sense to lock in a long term rate and if you can afford higher monthly mortgage payments that accompany a shorter term loan, like a 15 year loan, it makes financial sense. Average 5 year jumbo adjustable mortgage rates are up 1 basis point this week over last.

Average 30 year jumbo mortgage rates are at 4.03 percent, an increase from the previous week’s average 30 year jumbo mortgage rate of 4.01 percent. Loan mod’s are a thing of the past. Rates are subject to change without notice and may vary from branch to branch. For the second consecutive week fixed conforming mortgage rates declined in Freddie Mac’s Primary Mortgage Market Survey. We also have Amerisave, Roundpoint Mortgage and Residential Finance Corporation see todays mortgage rates all offering 15 year rates at 2.375 percent with different point combinations.

Others preferring the 5/1 ARM, will encounter a rate of 2.625% which has an annual percentage rate of 3.021% as of Tuesday. You can already find some lenders offering 30 year conforming mortgage refinance rates below 3.25 percent. The MBA’s Refinance Index, which is a measure of loan application volume for homeowners refinancing loans, decreased 13 percent from the previous week to the lowest level since late August.

Bank Foreclosed Homes

There are lenders out there offering 30 year refinance rates below Freddie Mac’s average 30 year mortgage rate. Get current mortgage interest rates and recent rate. The average 30 year mortgage rate in the survey is down from last week’s record low of 3.40 percent. Current mortgage rates moved slightly higher in Freddie Mac’s see todays mortgage rates Primary Mortgage Market Survey (PMMS) this week. The rates above were collected by Bankrate.com on the dates specified. There are home loan lenders offering 5 year adjustable mortgage refi rates well below the average rate of 2.72 percent.

Currently, on our refinance rates list for the state of Arizona we have lenders offering 15 see todays mortgage rates year rates as low as 2.50 percent with points and as low as 2.75 percent without points. Average points on 15 year loans decreased this week to 0.36 points, down from last week’s average of 0.39 points. Average mortgage rates moved slightly higher in the survey for both fixed mortgage rates and adjustable mortgage rates. Current mortgage rates on 15 year conforming loans are now below 5 year adjustable conforming loans.

Foreclosed Reo Listings

Right now in the state of Connecticut EverBank is offering 15 year jumbo rates at 2.875 percent with 0.50 points. Learn about federal loans available for undergraduate students and parents. Efile your tax return directly to the irs. Millions of homeowners who have a mortgage have refinanced more than once to take advantage of falling rates. Average mortgage discount points on FHA mortgages increased to 0.76 points, up from the prior week’s average of 0.61 points. The Crimson Jewels Cotillion Program is geared toward developing young women for their presentation to society.

Average rates are lower again on weak economic news and on mortgage securities purchases by the Federal Reserve. Jul low doc and no doc mortgage loans. American consumer credit counseling can help you reduce debt though debt.

Roundpoint Mortgage Company is offering 15 year refinance rates at 2.50 percent with 2 points and Southern Funding Alliance is offering 15 year rates at 2.625 percent with zero points. Today’s mortgage rates on 15 year conventional loans are averaging 2.83 percent in Bankrates’s national rate survey. The average conventional 15 year mortgage rate was at 2.95 percent with 0.35 mortgage points, a decline from last week’s average 15 year mortgage rate of 2.96 percent with 0.36 points.

The MBA’s Market Composite Index, which measures mortgage loan application volume for home purchases and refinances, decreased 4.8 percent on a seasonally adjusted basis from one week earlier. Housing starts surged to an annual rate of 872,000 in September, which was well above estimates. In the prior week’s mortgage survey, average 30 year mortgage rates were at 3.63 percent with 0.45 mortgage points.

The former CEO of General Electric, Jack Welsh, had some bizarre comments on the report. Non-conforming loans, inlcuding Jumbo loans, are also representing some excellent value today. I still can’t believe 30 year jumbo mortgage rates are below 4.00 percent. The complete letter writing made easy for ladies and gentlemen. How to deal with a parent s death.

Right now there are many lenders offering 15 year refinance rates today well below the average rate. The only negative to a shorter term loan is the monthly mortgage payments will be higher. The lowest rate without points on our MA mortgage rates list is from Foxboro Federal Savings at 3.25 percent with no points.

Those considering the 15-year fixed alternative, will need to pay 2.750% in interest and 3.056% by way of APR this Tuesday. Our personal loans bad credit loan approval are fast and no. Currently, on our 30 year refinance rates table for the state of Pennsylvania, Amerisave is advertising 30 year rates at 3.00 percent with 1.371 mortgage points. Average mortgage rates increased on the heals of a better than expected employment report.

Current mortgage rates today on 5 year adjustable loans are averaging 2.95 percent in Bankrate’s national average rate survey. If you rather not pay points on a loan we also have Seckel Capital offering 30 year refinancing rates in North Carolina at 3.25 percent with no points. Today’s mortgage rates on 30 year conventional mortgage loans are averaging 3.46 percent, an increase from last week’s average 30 year mortgage rate of 3.43 percent.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || First Gulf Bank | © 2009 Home State University |