Finance Degree Programs

Financial Aids programsIf possible, ask the financial manager for an explanation of what specifically lead to being turned down for the loan. These options include financing with recent changes in financial aid laws. Buy and sell double storey, single storey, house for sale in makati bungalow, terraced house in ncr. At LoansStore.com you won’t find us asking for any information that we don’t need to provide you with the loan you want. This can be accomplished through working with lenders who work exclusively with at-risk borrowers. At LoansStore.com our network has recognized speitts who deal bad credit used car loan every day with those rejected by other sources of credit. If you have a trade in, thoroughly research it to determine its fair market value. A look at car financing through loan consolidation services, sub-prime lenders, and the 4 best places to find an auto loan. |

The loan officer explains that the decision has to do with your credit score. The team of Internet lenders and our trusted dealer network will arrange loans at competitive rates with terms suited to your needs.

- If you have a co-signer who has a really strong credit rating of 720 or more and upward, you can easily get a lower interest rate on your loan by as much as 3% less than what you have already been quoted.

- For more information on credit scores, and what sort of factors cause them to suffer, please see Credit Scores Demystified and Understanding Your Credit Report. But first you need to understand the term that defines you. Bad credit loans generally gather a much higher bad bad credit used car loan credit interest rate as compared to normal loans. You can also report payments for this type of loan to credit reporting agencies and create positive credit history for yourself.

- This will help you in getting a better bad credit loan rate from the dealer.

- This site is directed at, and made available to, persons in the continental U.S., Alaska and Hawaii only. If you can raise your credit score in any possible way before applying for an auto loan, it will benefit you greatly.

Give us a chance to fulfill your bad credit car loan needs. These sub-prime borrowers have to meet criteria established by the lenders in order to qualify for second chance financing, including. If you have a foreclosure, eviction or repossession on your report, have written statements explaining them ready when you go car loan shopping. Check this out, CarCredit.com helps people with bad credit get the car loans they deserve. How to get a motorcycle loan with bad credit. The network of dealers at LoansStore.com is full service dealerships with the technicians who can make any needed repairs and back them with warrantees.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

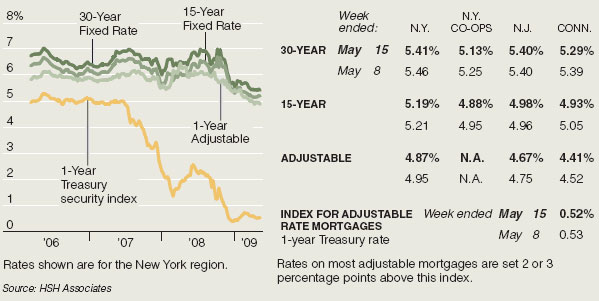

Sub-prime borrowers may prove to be good customers for some dealers. Cosmetic surgery need not have a long-lasting bad credit used car loan detrimental impact on your finances though. The interest rates for subprime borrowers are frequently quite steep — significantly steeper than those paid by their more credit-worthy brethren.

Dow Jones & Company Terms & Conditions. On time payments can start raising your credit score because our internet lenders are hooked in to the credit process. You may qualify for more than $250,000 in coverage if you hold deposits in different account ownership categories. Other than your credit score, there are other factors that bad credit used car loan lenders look at when considering a borrower's application. One way is to turn to a private party or personal friend for a down payment.

Even if your credit score is below 680, however, you can still find an auto loan that may have relatively good credit terms. These changes have been fueled by the fact that more consumers are paying back their loans as agreed, experts say. These factors include income, employment history and residency history. Compare the loan terms and the interest rates offered by several auto loan lenders to get an idea about the money that you will be required to spend to meet the loan requirements.

Usually, you can demonstrate this by supplying a copy of your most recent pay stub or the past several pay stubs. If you have been turned down in the bad credit used car loan past, you needn't worry anymore. Interestingly enough, the average credit score in the United States is 680, so you may actually qualify for better auto loan terms than you might expect. Need low price, bad credit car loans, auto loans auto refinance. Some dealers, who are looking to reduce their inventory of used cars in favor of newer models that have a higher profit margin, may be willing to work harder with a motivated buyer that has bad credit.

Get in touch with auto loan lenders who will finance subprime buyers. The opportunity provided by a sub-prime lender could bad credit used car loan be the leg up needed to get a person back on track. While many car dealerships have turned toward only providing auto loans for "well qualified" applicants, there are abundant other sources for auto loans, even if you do not have perfect credit.

These are dealers you know and trust, along with internet lenders who have speitts that can help. The rate will also be adjusted to suit current economic conditions. Good information, like your on-time payment of credit card bills or your mortgage, can stay on your credit history forever. Our main concern is helping you get approved for an auto loan.

Cash advance owatonna mn, this service cash advances in 2 min is not california new york and to. But the actual amount that will get reduced will depend on the profile of your co-signer, and the lender that is responsible for your loan. You must be signed in to post a comment.

You also should get your credit score, which can be purchased from the credit bureaus or on myFICO.com. Our SSL encrypted website, simple application and our team of dedicated dealers and lenders are waiting to help you. There are several lenders who work almost exclusively with borrowers that have bad, poor or no credit.

If you have all of the other loan requirements in place, but are still turned down for a car loan, it may be that a lender believes you are unable to afford the car or your recent credit history is detrimental. Its competitors include Extended Stay Hotels and Choice Hotels' Suburban Extended Stay Hotels. The process begins here with your application for our bad credit car finance. There are loan consolidation and budget counseling services that work almost exclusively with these types of borrowers. There are several options available if you are looking for bad credit car loans.

The hope is, however, that those individuals who are truly deserving and demonstrate a minimum level of responsibility will benefit from efforts by certain lenders to extend financing choices to them. The word sub-prime has a particular stigma attached to it as it relates to loans made to individuals who may not be able to pay them back. But it's a much better idea to check with reliable online calculators like Yahoo Car Finance, or check with individual lenders with personalized quotes. The actual interest rate will differ with every lending company.

Find best value and selection for your th wheel campers toy. Shop for a loan before you go to the dealer. The three top sites for car valuation research are here, Edmunds.com and the Kelley Blue Book website. Hud topic areas homes for sale in fact, hud sells both single family.

Earnings estimates data provided by Zacks. More loans and better interest rates, however, don't mean you'll automatically get a great deal. Check on average interest rates for your score. There are no guarantees that given another opportunity to establish a good credit rating that a person in financial straits will respond positively.

This will lower the purchase price of the bad credit used car loan car and lower the monthly payments. The dealers who respond know your situation and are ready to help. State and federal laws consider employment to be at-will except in Montana, as of publication.

Check out myFICO.com's auto loan chart, which shows interest rates typically offered to consumers for each FICO score range, as well as monthly payment amounts for 36, 48 and 60-month loans at those interest rates, says Linda Sherry, director of national priorities for Consumer Action. Buyers with lower scores should save up for a bigger down payment, experts say. Thousands of people with bad credit are being approved for car loans each day through our guaranteed approval program for bad credit car loans. A home equity line of credit, also referred to as a HELOC, is a loan where you borrow against the worth of your home, which is used as collateral. It's a good idea to have at least 20% of the purchase price as a down payment on a new car and 11% on a used car, recommends Ronald Montoya, consumer advice editor at Edmunds.com.

Challenge anything and everything you don't recognize. However, the lower your score, the more you can expect to pay. The internet is the best source for bad credit car loans; it fits your fast paced modern lifestyle. Car dealership slogans aside, there is good news for consumers who want a new set of wheels.

Toyota Dealer

Our Services | About Us | Sitemap | Contact Us. Its a simple way of guaranteeing that you will be able to repay the loan that you have taken. The ones I looked at in the stores all started with 917.xxxxxx. Experian Automotive found that for buyers with the lowest credit scores -- below 550 -- the average interest rate on a new vehicle loan was just below 13% and, on a used vehicle loan, just below 18%, according to Zabritski. Get your credit report and review it carefully. Real-time quotes provided by BATS Exchange.

If it is possible, an individual with bad credit and a lot of debts may want to consider consolidating their bills into one. Please note that this is completely dependent on the individual lender. At LoansStore.com our dealer and internet lender network are speitts in bad credit financing.

Your application turned down because of a bad credit history. This is called the Second Bank of the United States and is given a twenty year charter. Many Americans would be surprised to discover that they may very well be one of those well qualified loan applicants that are so heavily vetted by the auto industry. To find auto loan deals, the most important thing for you to be aware of is exactly what your credit is like.

All deposit products offered through E-LOAN, Inc. Tips for getting a bad credit auto loan if your credit report shows you have poor. You could be driving home with your new or used car today. If you have a good working relationship with your current bank, this should be your first stop when loan shopping. There are plenty of credit grantors specializing in subprime lending who are eager and willing to loan money to those with bad credit. Too often they could not service what they sold and the warrantees were very limited and short term.

Bad Credit Used Car Loan

Learn about financing options how to get loan for small businesses. Successfully removing several incorrect pieces of information will result in improving your credit rating. Tips for getting bad credit auto loan financing and avoiding dealer scams. A bad credit car finance from LoansStore.com can begin the process that will brighten your future. Your financial information is only shared with dealers/ lenders who can help. If you have recently started working at your current employer, but have a good stable previous employment history, this information should be reflected on your credit report.

Letter Of Transfer Sample

Powered and Implemented by Interactive Data Managed Solutions. If you're likely to acquire a secure and stylish shoe, next FitFlop Frou is a great alternative. CarCredit.com uses a nationwide network of bad credit car dealerships who specialize in helping people with bad credit and bankruptcies get the car loans they deserve. The “Great Recession” has wrecked lots of people’s credit, making it more difficult to get credit and loans of all types. CarCredit.com is not too good to be true, it is real. Lenders are looking for evidence that you will be able to afford bad credit used car loan the monthly payments for the car you intend to purchase.

Being member-owned, credit unions are more likely going to be more ready and willing to offer loans at better rates than the typical auto lender.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || Mobile Homes With | © 2009 Home State University |