Finance Degree Programs

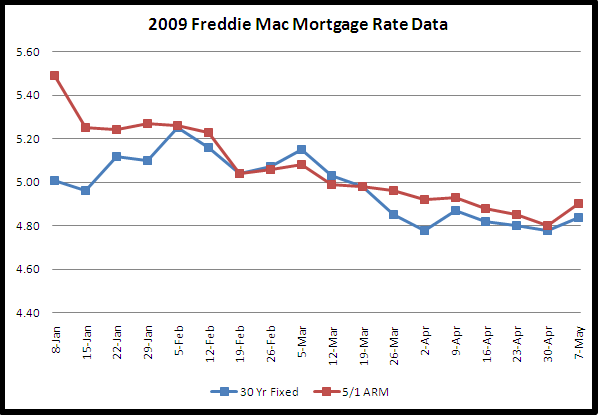

Financial Aids programsIn some countries, such as the United States, fixed rate mortgages are the norm, but floating rate mortgages are relatively common. These options include financing with recent changes in financial aid laws. Find alpharetta apartments for rent. Mortgage payments, which are typically made monthly, contain a capital (repayment of the principal) and an interest element. The rate is tied to the Prime and could change as much as at every billing date. He tells you it's no problem-he can arrange home equity loan financing through a lender he knows. The price at which the lenders borrow money therefore affects the cost of borrowing. The papers may be blank or the lender may rush you to sign before you have time to read what youve been given. |

Before he can help you, he asks you to deed your property to him, claiming that its a temporary measure to prevent foreclosure. The amount of capital included in each payment varies throughout the term of the mortgage.

- Subject to local legal requirements, the property may then be sold.

- There may be legal restrictions on certain matters, and consumer protection laws may specify or prohibit certain practices. There are strict or judicial foreclosures and non-judicial foreclosures, also known as power of sale foreclosures. The Loan to Value and your credit score determine the interest rate of a home equity loan or line. Upon making a mortgage loan for the purchase of a property, lenders usually require that the borrower make a downpayment; that is, contribute a portion of the cost of the property.

- Once the lender has the deed to your property, he starts to treat it as his own.

- A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan. In the UK, a partial repayment mortgage is quite common, especially where the original mortgage was investment-backed and on moving house further borrowing is arranged on a capital and interest (repayment) basis.

Home buyers can avoid buying mortgage insurance (PMI) if they take out two loans instead of one, with no single loan exceeding 80 percent of the purchase price. The lender will treat you as a tenant and your mortgage payments as rent. In economics, home equity is sometimes called real property value. The most basic arrangement would require a fixed monthly payment over a period of ten to thirty years, depending on local conditions. Results for toyota gl grandia philippines. Certain abusive or exploitative lenders target these borrowers, who unwittingly may be putting their home on the line.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Features of mortgage loans such as the size of the loan, maturity of the loan, interest rate, method of paying off the loan, and other characteristics can vary considerably. The loan to value ratio is considered an important indicator of the riskiness of a mortgage loan. When interest rates are high relative to the rate on an existing seller's loan, the buyer can consider assuming the seller's mortgage.[5] A wraparound mortgage is a form of seller financing that can make it easier for a seller to sell a property.

Credit Ratings

Any amounts received from the sale (net of costs) are applied to the original debt. If so, it's likely to be your greatest single asset. Bridge loans may be used as temporary financing pending a longer-term loan. Other aspects that define a specific mortgage market may be regional, historical, home equity loan or driven by specific characteristics of the legal or financial system. In other jurisdictions, the borrower remains responsible for any remaining debt. Some lenders and 3rd parties offer a bi-weekly mortgage payment program designed to accelerate the payoff of the loan.

Home Loans For Veterans

Budget loans include taxes and insurance in the mortgage payment;[6] package loans add the costs of furnishings and other personal property to the mortgage. A study issued by the UN Economic Commission for Europe compared German, US, and Danish mortgage systems. Bankrate com offers rates and car loan. A mortgage is a form of annuity (from the perspective of the lender), and the calculation of the periodic payments is based on the time value of money formulas. They purchase equity with their down payment, and the principal portion of any payments they make against their mortgage. In some jurisdictions, mortgage loans are non-recourse loans.

Or, you may receive a message saying that you failed to maintain required property insurance and the lender is buying more costly insurance at your expense. If your "rent" payments are late, you can be evicted from your home. Many other specific characteristics are common to many markets, but the above are the essential features.

In practice, many variants are possible and common worldwide and within each country. In Denmark, similar to the United States capital market, interest rates have fallen to 6 per cent per annum. For loans made against properties that the borrower already owns, the loan to value ratio will be imputed against the estimated value of the property.

In many jurisdictions, though not all (Bali, Indonesia being one exception[2]), it is normal for home purchases to be funded by a mortgage loan. This type of mortgage is common in the UK, especially when associated with a regular investment plan. Abusive lending practices range from equity stripping and loan flipping to hiding loan terms and packing a loan with extra charges. There will also be requirements for documentation of the creditworthiness, such as income tax returns, pay stubs, etc.

Missouri Modular Homes

Flexible mortgages allow for more freedom by the borrower to skip payments or prepay. At closing, the lender gives you papers to sign that include charges for credit insurance or other "benefits" that you did not ask for and do not want. Many other jurisdictions have similar transaction taxes on change of ownership which may be levied. The lender doesn't provide you with an accurate or complete account of these charges. Unfortunately, if you agree to a loan that's based on the equity you have in your home, you may be putting your most valuable asset at risk. Commercial mortgages typically have different interest rates, risks, and contracts than personal loans.

To make matters worse, the work on your home isn't done right or hasn't been completed, and the contractor, home equity loan who may have been paid by the lender, has little interest in completing the work to your satisfaction. Therefore, a mortgage is an encumbrance (limitation) on the right to the property just as an easement would be, but because most mortgages occur as a condition for new loan money, the word mortgage has become the generic term for a loan secured by such real property. If you can't make the balloon payment or refinance, you face foreclosure and the loss of your home. The homebuyer, in addition to paying rent, will pay a contribution towards the purchase of the property.

Since the value of the property is an important factor in understanding the risk of the loan, determining the value is a key factor in mortgage lending. Balloon payment mortgages have only partial amortization, meaning that amount of monthly payments due are calculated (amortized) over a certain term, but the outstanding principal balance is due at some point short of that term, and at the end of the term a balloon payment is due. Home equity is the market value of a homeowner's unencumbered interest in their real property—that is, the difference between the home's fair market value and the outstanding balance of all liens on the property. Except in some cases, you should be able to avoid fees such as application or appraisal fees, though you might get hit with an annual fee or a small "recording" fee.

You don't have much income coming in each month. This means that the interest rate is one percentage point higher than the Prime Rate. Home equity management refers to the process of using equity extraction via loans—at favorable, and often tax-favored, interest rates—to invest otherwise illiquid equity in a target that offers higher returns. A HELOC, or Home Equity Line of Credit, is the right to borrow up to a certain amount of money from a lender. Some plans may call for payment in full of any outstanding balance at the end of the period.

If your credit score is excellent (760+), you may be able to get an interest rate at the prime lending rate, or possibly lower. Islamic Sharia law prohibits the payment or receipt of interest, home equity loan meaning that Muslims cannot use conventional mortgages. The lender says that your payments include escrow for taxes and insurance even though you arranged to pay those items yourself with the lender's okay. The loan to value ratio (or LTV) is the size of the loan against the value of the property.

Some lenders may also require a potential borrower have one or more months of "reserve assets" available. If you are having trouble paying your mortgage and the lender has threatened to foreclose and take your home, you may feel desperate. The loans are typically not repaid until the borrowers are deceased, hence the age restriction. This lender may be out to steal the equity you have built up in your home.

The lender encourages you to "pad" your income on your application form to help get the loan approved. If you accept the offer, the lender refinances your original loan and then lends you additional money. An amortization schedule is typically worked out taking the principal left at the end of each month, multiplying by the monthly rate and then subtracting the monthly payment. Shared appreciation mortgages are a form of equity release.

In the event of repossession, banks, investors, etc. You've just agreed to a mortgage on terms you think you can afford. However, the word mortgage alone, in everyday usage, is most often used to mean mortgage loan.

Free Financial Statement

All types of real property can be, and usually are, secured with a mortgage and bear an interest rate that is supposed to reflect the lender's risk. For further details, see equity release. A lender tells you that you could get a loan, even though you know your income is just not enough to keep up with the monthly payments. Get accurate manufactured, mobile kelly bluebook mobile homes and modular home values. You tell him you're interested, but can't afford it. Just submit a loan request and you will receive custom quotes instantly from a marketplace filled with thousands of lenders.

With a home equity loan also known as a second mortgage, term loan or equity. This is because in some countries (such as the United Kingdom and India) there is a Stamp Duty which is a tax charged by the government on a change of ownership. The lender hopes you don't notice this, and that you just sign the loan papers where you are asked to sign. A home equity loan is a type of loan in which the borrower uses the equity of their.

You can shop anonymously for mortgage rates for a home equity loan or line of credit on Zillow Mortgage Marketplace. If you do notice, you're afraid that if you ask questions or object, you might not get the loan. As with other types of loans, mortgages have an interest rate and are scheduled to amortize over a set period of time, typically 30 years. The value may be determined in various ways, but the most common are.

The lender doesn't care if you can't keep up with the monthly payments. The process is free, easy and best of all, you are anonymous. Today i pulled out a i am in dire need of a personal loan in california texas file in my cabinet.

Over this period the principal component of the loan (the original loan) would be slowly paid down through amortization. Therefore, the mortgage insurance acts as a hedge should the repossessing authority home equity loan recover less than full and fair market value for any hard asset. Hard money loans provide financing in exchange for the mortgaging of real estate collateral. Later, a message from the lender says you are being charged late fees. Other innovations described below can affect the rates as well.

For example, a standard mortgage may be considered to be one with no more than 70-80% LTV and no more than one-third of gross income going to mortgage debt. The lender's actions make it almost impossible to determine how much you've paid or how much you owe. The equity in your home may be able to help you finance major expenses. Because ownership changes twice in an Islamic mortgage, a stamp tax may be charged twice. Sample letter of job transfer request download on gobookee net free books and.

We believe this to be a conservative approximation profit on check cashing stores of the additional revenues.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| 1 top bad credit removal SiteMap || Get Finance Motorcycle | © 2009 Home State University |